European stocks up after 3-day pullback

Yesterday American stocks showed a slight pullback on the back of

growing US Dollar Index. They have been moving in opposite directions

lately. Investors' sentiment was mixed after Fed reported on Wednesday

they were not in a hurry with rate hike. It resulted in a strong market

movement. The statement undermined the dollar while the euro has shown

the sharpest weekly increase in 18 months. However, some investors

believe that other majors are even in a worse situation and the dollar

has been strengthening today. The decline in Philadelphia Manufacturing

produced additional negative effect on stocks. In March it has plunged

to its weakest 5 points since February, 2014. Investors are concerned

about labor market statistics that may be worse-than-expected. Yesterday

the trade volume on American stocks was 7% below the monthly average,

amounting to 6.2 bln shares. No macroeconomic news are expected today in

the US.

After the 3-day pullback European stocks are growing today together

with American indices futures. Greek Athex edged 3%. Alexis Tsipras

assured European creditors, that his coalition would soon present a full

pack of anti-default measures. European shares are also underpinned by

estimated merger deals within construction and bank segments. Holcim and

Lafarge gained 1.3% and 3.5% as TSB and Banco Sabadell added 2% and

1.5% respectively. Nikkei

has recorded today its 15-year high. The index has been rising for 6

straight weeks. Nintendo shares have jumped 35% in 2 days after the

company reported it was going to expand to mobile games market. To be

noted, Bank of Japan kept its monetary stimulus program unchanged this

week. Bank head Haruhiko Kuroda stated that it was necessary to reach

target 2% inflation rate this financial year even by means of raising

emission. We believe that due to this announcement the yen ceased its

surge. Forthcoming economic data from japan are anticipated on Tuesday.

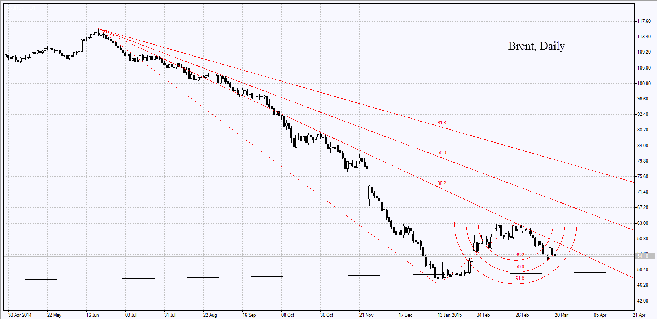

Oil prices

have been falling 2 consequent days after Kuwait declared that OPEC

should keep the current oil output til the next meeting in June. The

prime minister said that he wouldn't be surprised if oil declined below

$50 per barrel in several weeks. The export from Iranian South oil

terminals has advanced in March to 2.66 mln barrels per day as compared

to 2.29 in February. The reason is that good weather in the Persian Gulf

allowed using a large number of tank ships. The country is going to

raise export to 3 mln. Besides, due to oil workers strike, US crude

reserves have reached their 80-year high. Angola forecast surge in oil

production to 1.84 bln barrels which is 10% above the previous year

supply. Selling carbohydrates makes up about 50% of GDP and accounts for

80% of taxes and 90% of exports in the country.

Copper quotes expanded due to strike at an Indonesian mine owned by

Freeport-McMoRan company.

Gold has marked the maximum weekly gain since January because of Fed

statement. SPDR Gold Trust has reported growing reserves for the first

time. Shanghai Gold Exchange premium has reached $6-7 in relation to

London. To be noted the delta between gold and platinum ounce prices

rose to its 2-year high ($55). That may indicate that platinum is

undervalued and be used for creating a PCI.